is nevada tax friendly for retirees

Social security benefits are not taxed and income from pensions are eligible for deductions. Alaska Florida Nevada New Hampshire South Dakota Tennessee.

Three main types of state taxesincome tax property tax and sales taxinteract to determine the most tax-friendly states if youre retired or youre about to retire.

. Withdrawals from retirement accounts are not taxed. The western state of Nevada is yet another tax-friendly state for retirees with no state taxes. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level.

It achieves its perch at the top of our list of financially. Nevada is extremely tax-friendly for retirees. While Wyomings financial advantages begin with the fact that the Cowboy State has no state income tax thats just the start.

Nevada has no income tax. Nevada Retirement Tax Friendliness. Nevada is extremely tax-friendly for retirees.

This includes income from both Social Security and retirement. Nevada is a great state for retirees looking to make their savings last. 10 above the national average.

Social security benefits are not taxed nor are withdraws from retirement accounts and public or. With no income tax theres also. Arizona is a tax-friendly state for retirees.

Some States Are Lowering Taxes To Entice Retirees To Relocate. There is no state income tax and Social. Social Security income is not taxed.

With no income tax theres also no tax on 401k or IRA distributions. Nevada is one of the most tax-friendly states for retirees according to Kiplingers Personal Finance magazine. The cost of living in Nevada is up to 83 higher than in Arizona.

In both states the cost of living is rather expensive for retirees as both are higher than the national average. By Paul Arnold May 31 2022. The state income tax bracket is as near to the ground as 463 and retirees can get a.

Tennessee is tax-friendly toward retirees. Colorado normally ranks among the top tax-friendly states for retirees and senior citizens. Generally states without any income taxes may seem like the first choice to reduce your tax burden.

10th on the list was Tennessee followed by Arizona Alabama Colorado South Carolina Nevada. Nevada is a very tax-friendly state towards retirees. Income from a 401k is taxed though.

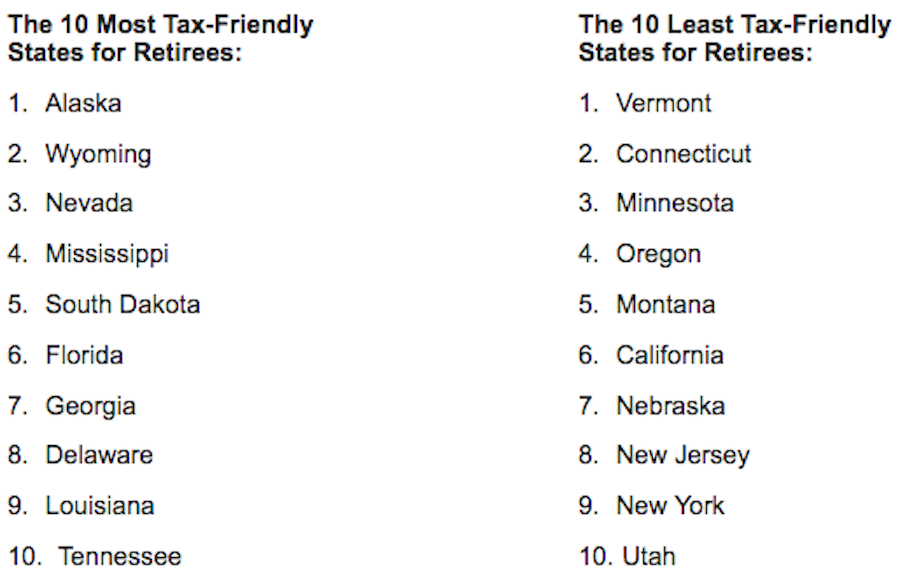

The 10 most tax-friendly states for retirees. Nevada doesnt tax Social Security or pension income nor does it have an estate tax.

3 Tax Friendly States For Retirement

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

The Most Tax Friendly States To Retire

15 States That Don T Tax Retirement Income Pensions Social Security

10 Most Tax Friendly States For Retirees Kiplinger

Which States Are Best For Retirement Financial Samurai

15 States That Don T Tax Retirement Income Pensions Social Security

9 States With No Income Tax Kiplinger

Florida Makes The List For Most Tax Friendly States Srq Daily Oct 17 2016

9 States With No Income Tax Bankrate

![]()

Tax Friendly States For Retirees Best Places To Pay The Least

Surprising Data Reveals The Top 25 Tax Friendly States To Retire Gobankingrates

Nevada Retirement Tax Friendliness Smartasset

Nevada Retirement Tax Friendliness Smartasset

12 States That Won T Tax Your Retirement Income Kiplinger

2021 State Business Tax Climate Index Tax Foundation

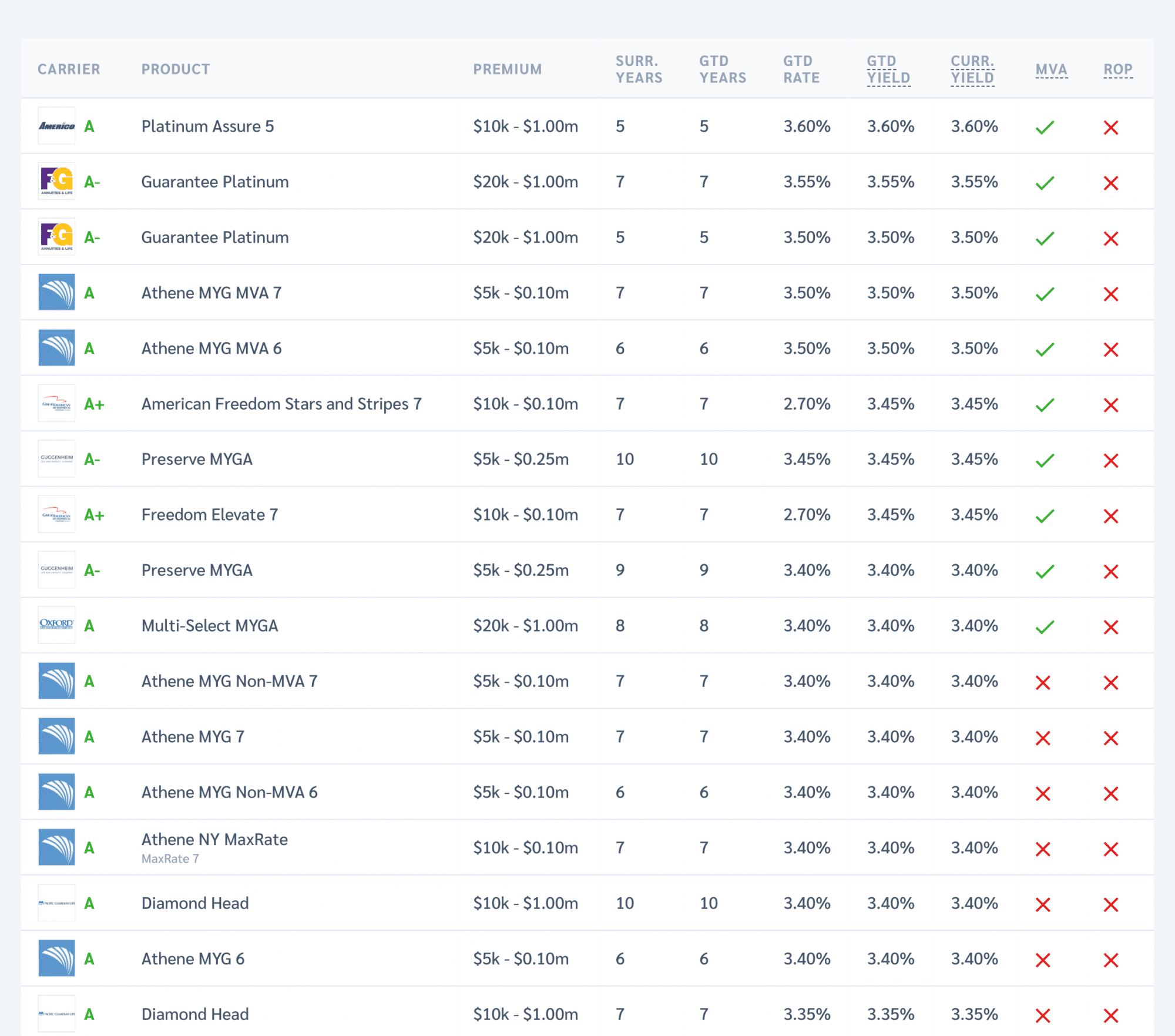

10 Most Least Tax Friendly States For Retirees Cheapism Com

State By State Guide To Taxes On Middle Class Families Kiplinger